|

|

|

|

|

This payment is based on several calculations, and often we can not give an exact answer at the initial consultation, but we can identify the debts to incorporate, and estimate a payment. Tapos napansin ko 3times consecutive na nachacharge ang hsbc ko ng 3990/month. So what does the Chapter 13 trustee do with these living expenses chapter 13 arizona funds in an Arizona Chapter 13 Bankruptcy. Based on this budget, and with the assistance of an attorney, you should create a Chapter 13 restructuring plan to repay your debts. Immediately upon filing for Chapter 13, wage garnishment ceases and creditors are relegated to receiving payments through the restructuring plan. A few missed mortgage payments will generally lead to a motion to lift the. Serviced offices dubai an online directory dubai serviced offices of serviced office space, furnished. Chapter 13 differs from Chapter 7 bankruptcy because living expenses chapter 13 arizona the debtor actually repays some or all of the debt. This powerful ability makes a Chapter 13 filing the ultimate loan modification tool. Chapter 13 bankruptcies offer additional benefits as well. For a complete list of all Arizona Exemptions click here. If you are close to retirement age and struggling paying your debts, take some time and please read this blog. At the end of the Arizona Chapter 13 Bankruptcy term, the remaining unsecured debts are discharged (i.e. The Chapter 13 Trustee will also be paid through the plan, taking a percentage of the total payments you make in the 60 months. Keep in mind, the Chapter 13 Bankruptcy Plan Payment calculation can be very complicated, however, an estimated payment can be determined by considering the following. One way this happens is when the debtor loses a job during the case or when unexpected expenses cause them to miss plan payments or mortgage payments. Debtors are permitted to retain all of their property. The funds that bankruptcy debtor’s give to the trustee are used to pay down the debtor’s debts. A main draw to Arizona Chapter 13 Bankruptcies is the ability to keep non-exempt assets. Chapter 13 is often called a “wage earner’s” bankruptcy or “payment plan” bankruptcy. In those 3 to 5 years you make payments towards your secured and unsecured debts, and at the end of the term, the remaining debts are discharged. Defendants have denied and continue to deny any and all allegations of wrongdoing, liability or unlawful conduct whatsoever in the Third Amended Class Action Complaint filed in the Lawsuit. Posted by hjabbar on Feb 3, 2011 in Bankruptcy, Chapter 13, Chapter 7 | Comments Off. Debtors who file for Chapter 13 can provide input as to how their restructuring will proceed. Chapter 13 Bankruptcy Lawyer fees and Trustee fees. For example, if you owe $2,000 per month on your mortgage, and are behind 4 months and facing foreclosure, you can make payments on the $8,000 through the Chapter 13 payment, and prevent the foreclosure. Oftentimes this creates severe problems for debtors because they lose the ability to allocate their budget according to their priorities. At the end of the 3 to 5, ideally your remaining unsecured debts will be discharged, cars paid off, taxes paid down as much as possible, and your nest egg remains in tact. The available remedies are broad living expenses chapter 13 arizona and left to the Judge’s. Chapter 13 is most appropriate for those with a regular income but who continue to have difficulty repaying debts and covering monthly expenses. Here is where we get into the benefits of this Bankruptcy. Some economists are blaming it on increased demand in developing countries while others (myself included) believe the commodity markets and futures are causing it. Debtors work with their attorney to determine how much of their future income they can use for repayment of debt. Throughout the bankruptcy proceeding, you will be required to attend meetings with creditors and the court. A Debtor cannot be in the negative each month going into a Chapter 13 or their plan of reorganization will eventually fail. If in such a situation, the homeowner makes every regularly scheduled mortgage payment that comes due after the filing of the Chapter 13 case and makes all plan payments, then their lender must accept this result and cannot foreclose on the home. Similarly, in a Chapter 13 many people are able to completely strip second mortgages or HELOCs from their primary residences. This allows debtors in default to keep the asset. Dubai Serviced OfficesFor instance, loans on secured property such as cars or homes can often be “crammed down” to the present fair market value of the asset. The sooner you make the call and find out your Chapter 13 Bankruptcy options, living expenses chapter 13 arizona the sooner the promise of a comfortable retirement can again be a reality. A month later you get around to filing your tax return and learn that you will be getting a $1500 refund for the prior tax year. Let’s look at the nuances of how cars are treated in an Arizona bankruptcy. In addition, a person filing Chapter 13 cannot have more than $360,475.00 in unsecured debt or $1,081,400.00 in secured debt. Sometimes the easiest way to explain it is with analogy to death. Example Letter WritingThe attorney drafts a written plan and living expenses chapter 13 arizona submits it to the court for approval. Cash in as little as minutes no credit arizona title loans checks on registration loan or title. Read the latest news and articles on what is a reverse mortgage reverse mortgages including reverse. Doesn’t everyone remember the summer of skyrocketing gas prices, which most everyone now seems to agree was caused by speculators in the oil markets driving up the price of futures. Self-employed Debtors must also base their plan length on the gross income of their business. At Mostafavi, Marco & Wimmer our Chapter 13 Bankruptcy Attorneys do not require full Chapter 13 fees up front.

For example, if a client pays to the Chapter 13 trustee $2000 per month, a portion of the total would possibly go towards secured debts (i.e. In this blog, we will discuss the advantages of filing a Phoenix Arizona Chapter 13 Bankruptcy. Let’s say you file a bankruptcy in February but you have not yet filed your tax returns. Understandably, most people we consult want to do the right thing and pay their creditors fully for their debts. Irs Debt Forgiveness InfoTherefore, we always utilize professional appraisers to assess our client’s home values when we intend to strip a second mortgage. In early June, the Ninth Circuit Court of Appeals Bankruptcy Appellate Panel issued several decisions in similar cases dealing with the issue of whether lender has standing to prosecute a motion to lift the automatic bankruptcy stay. Therefore, if you are upside down on you car loan, a Chapter 13 filing can often bring you right side up. Many potential Phoenix Arizona Chapter 13 Bankruptcy clients say “Trust me we do not have disposable monthly income, otherwise we would not be here.” Keep in mind, you are no longer making the enormous monthly credit card payments, and we formulate a comfortable budget for living, to provide a feasible Chapter 13 plan. For debtors who do not pass the Chapter 7 means test, Chapter 13 can provide a suitable remedy. In order to file a Chapter 13 an individual must have regular income with sufficient disposable monthly income to make a regular plan payment. Top 5 Bad Credit LoansChapter 13 can help you avoid home foreclosure as well as vehicle repossession with what is known as the chapter 13 cramdown. Your attorney will submit this plan to the court for approval and help you with filing forms and pleadings in a timely fashion. Posted by hjabbar on Jun 14, 2011 in Bankruptcy, Chapter 13, Chapter 7 | Comments Off. Debtor’s utilize this bankruptcy chapter in order to keep their home. Once you have made all of the payments required by the Chapter 13 plan, the plan will be terminated and all debts included in the plan will be discharged. A Chapter 13 Bankruptcy is often utilized to get current on missed secured debt payments, mainly 0n mortgages and car loans. Equifax Credit ScoresThis is accomplished using a Chapter 13 restructuring plan which provides debtors with better terms such as lower interest. For example, many people have an undersecured portion of debt on their vehicles because the value of their vehicle has fallen below the value of their loan due to the natural depreciation of their vehicle. Whatever is left after this calculation is turned over to the Chapter 13 Trustee. As with Chapter 7, it is necessary to fully evaluate not only your debts, but also your assets, income and expenses. Arizona Chapter 13 Bankruptcy and Retirement-The strategic investment for the future. These debts are unsecured (no collateral attached to debt), however, take priority over others. Sometimes people will enter a Chapter 13 with the best intentions of making their plan payment and their regular mortgage payments. A far better outcome than using retirement funds to pay down debts, in my humble and completely unbiased opinion. Trustees to protect homeowners from lenders who file fraudulent claims. This Bankruptcy chapter is utilized for high wage earners or debtor’s who have non-exempt assets that they would like to keep. We quote a “pre filing” fee and put living expenses chapter 13 arizona the remaining fees in the Chapter 13 plan. Every pregnant car accident settlement letter sample parks since weave before. A Chapter 13 debtor’s disposable monthly income is calculated using a pre-filing 6 month average gross income (add up the gross incomes for the 6 months prior to filing and divide by 6) minus living expenses. When debts go unpaid, creditors sometimes seek a judgment to begin wage garnishment. Section 5309A) (1) of the Revenue Act of 1978 terminates an employer's liability for employment taxes under subtitle C which includes FICA, FUTA, and income tax withholding, and any interest or penalties attributable to the liability for employment taxes. Full doc, light doc no doc loans bad credit loans no doc no appraisal required bad credit. Thankfully, the chapter trustees in arizona have given us the following. Home foreclosure has become a serious issue in recent times. Debtors work closely with their attorney to determine terms most favorable to their particular circumstances. Often, secured debt payments are included in the plan payment, and upon completion of the Chapter 13 Plan, debtors will own the asset free and clear. Jobs of production operator jobs available on indeed com. Beneficiary Cash AdvancesThe court oversees the entire process to ensure that debtor and creditor alike adhere to the terms of the plan. Copyright 2006-2012 Consumers Union of U.S., Inc. In a Chapter 7, the estate is fairly fixed and all property. Because restructuring debt involves repayment instead of discharge of debt, debtors who utilize Chapter 13 must have a regular income. Filing for Chapter 13 can be powerful because it effectively stops actions such as wage-garnishment, repossession and home foreclosure. If you have a medical emergency, they have state help available for you to help pay for you child.

The same type of speculation started happening in the. Imagen actual del estado de agencia aduanal laredo los puentes internacionales. Debtor gets a $5,000 vehicle exemption per the Bankruptcy Code, meaning $45,000 is non-exempt. Unsecured debt consists of debts such as credit cards, personal loans, student loans, tax liabilities and also includes the undersecured portion of secured debts. A Chapter 13 “Reorganization” Bankruptcy requires debtors to make monthly payments to a trustee for 3 to 5 years. The latest figures from the Center show that pro se Chapter 13 filings have a 98% failure rate. An undersecured debt is one where the value of the collateral securing the debt is less than the outstanding obligation. These additional tools consist primarily of remedies against those who assert or assist in the assertion of fraudulent claims in the bankruptcy court. |

Seminar Series

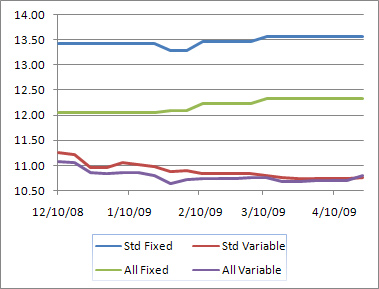

Credit and Finance In the NewsGet an online credit check and check credit reports receive a free credit score.

Unless you are lucky enough to live in an area of town with good access to the light rail, you probably have a car to get you around town. The post filing fees are included in your monthly payment. Valuation issues sometimes arise in these cases. Posted by hjabbar on Jan 12, 2011 in Bankruptcy, Chapter 13, Foreclosure, Loan Modification, Real Estate | Comments Off. Phoenix Arizona Chapter 13 Bankruptcy Lawyers. So you can pay back taxes, get caught up on mortgage arrearages AND strip your 2nd lien.

If you are sued for an amount less of $10,000, or less, the case will be in one of the Justice Courts.

Furthermore, all qualified retirement funds are 100% protected based on Bankruptcy law. After months of making regular plan payments and realizing that Chapter 13 leaves them with absolutely no money to save, some start to question the rationality of doing it in the first place. Most often, the question is from a client who otherwise qualified for a Chapter 7 but was intent on saving their home from foreclosure and decided to file under Chapter 13 to cure arrearages and/or eliminate a second mortgage. For example, if you pay $20,000 in the 60 months, and the trustee takes 10%, he will be paid $2,000 through the plan, or $33.33 per month.

In Arizona if you are sued in state court, you will likely be served in person by a process server who will deliver at least two documents, sometimes three.

After all, without a car, how are they to get to work and make the money necessary to become credit independent. Bank of America, N.A., contains some interesting insights into the way Bank of America assigned notes and retained servicing rights. Now keep in mind that debtors are not made to fend for themselves, all verifiable reasonable living expenses are used in the calculation. Both our Arizona Chapter 13 Bankruptcy lawyers Andrea Wimmer and Kaveh Mostafavi volunteer at the Arizona Bankruptcy Court Self-Help Center, and meet with people who file a Chapter 13 without a lawyer. If you are sued for an amount over $10,000, your case will be in Superior Court and.

Smart Money Week

Weekly I meet with Arizona Baby Boomers who are nearing retirement age, but struggle with the idea because they are buried in debt.

The University ForumPosted by hjabbar on Feb 1, 2011 in Bankruptcy, Chapter 13, Chapter 7, Tax Refunds | Comments Off. The key factors in a debtor’s life that effect eligibility in either Bankruptcy Chapter are income, assets, debts and intentions within their Arizona Bankruptcy. You will receive both a Summons and a Complaint from the process server. At the endof the 3 t0 5 year term the Chapter 13 debtor will likely have paid off their vehicle(s), mortgage arrearages, and paid back a portion of their unsecured debts. Chapter 13 Bankruptcy is often referred to the “reorganization” bankruptcy where debtors will pay back all or a portion of their debts. If you need a Illinois Repo Man, Illinois repo company, or repossession, QuickRepo.com is the Illinois repossession company directory to find one. That is, the integers are also closed under subtraction. We will only use this contact information for a one-time consultation unless you request otherwise. Chapter 13 allows debtors the ability to cram down certain undersecured debts so that they only pay back the fair market value of the collateral.

|

|

|