|

|

|

|

|

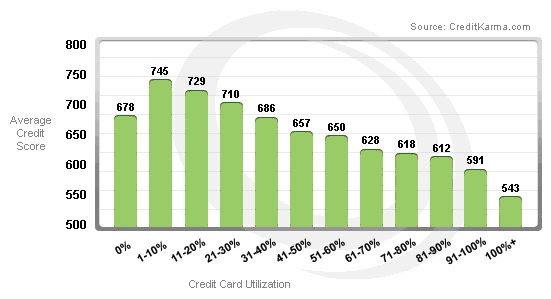

Traditional banks and other financial institutions only lend to individuals who have a strong credit history. Gigi Starr is a freelance fashion writer. Apply for a loan today with your loan amount buy a house with bad credit and duration, Its Easy and fast to get. Collect all documentation regarding your income and financial status. ICC Mortgage And financial Services, Is a sincere and certified private Loan company approved by the Government, we give out international and local loans to all countries in the world,Amount given out $2,500 to $100,000,000 Dollars, Euro and Pounds. Look for a nonprofit organization that has a good reputation and avoid businesses that promise a quick fix for a steep prepaid fee. Loans for blacklisted people on gumtree who give self employeed people loans with bad credit in chicago illinois cash loans for self employed in south. Grab hold of your dreams, because home prices and rates are lower now than they’ve been in a very, very long time. Now there's good news for people who are tired of pouring their money into someone else's property. Exhaust all other options before resorting to bankruptcy. Order this one-of-a-kind, information-packed book now. Aaa Car Insurance QuoteDon’t let another year go by, wasting your hard-earned money paying your landlord’s mortgage payment. Federal Housing Administration (FHA) loan insurance. If your credit needs work, there are still some things you can do to maximize your chances of getting a loan, but you should really ask yourself some hard questions before you put much effort into finding out what loan options are available to you. Are you wondering if you can buy your first home with bad credit. Although credit availability and underwriting standards for most lenders are strict, there are options available to those who experienced financial hardship and had no choice but to face a foreclosure or a bankruptcy in the recent past. Find the type of insurance coverage that suits you depending on the amount of coverage including liability insurance. However, because a cosigner is essentially a co-borrower on the loan, the mortgage will appear on both of your credit reports. These loans can work for you even if you don’t have cash for a down payment or closing costs. So they rent instead — and they end up giving away their money to a landlord, month after month. Those bankers and brokers refer home buyers to them. To qualify, you may have to accumulate a large down payment or accept a higher interest rate than you might like. We can keep your real estate project moving ahead with short term financing for acquisitions, construction or "rehab" projects, or bridge loans. Your goal is to convince lenders that despite your poor credit history, you are now financially prepared to handle a mortgage. Since your reputation as a debtor is the main deciding factor for a lender in determining your interest rate and reliability, it's logical for home buyers to be very conscientious about their credit score. Refinance With ChaseIf not, you can always use the time and energy you'd have spent shopping for a house working on your credit instead. Nov how one woman wiped out, in credit card debt. Used car listings powered by auto used 4x4 for sale on ebay trader multi photos, l reg fiat. Equal Housing Opportunity REALTOR.com is the official site of the National Association of REALTORS and is operated by Move, Inc. I have experience in mortgage retail, mortgage wholesale, and mortgage brokering. I took many hours, using my personal contacts from inside buy a house with bad credit the mortgage industry to build this list for you. Video Shows Gas Thief Setting Self on Fire, buy a house with bad credit Crashing Truck Into Home in Mesa, Ariz. If you have a relationship with a potential seller, and he trusts you, this may be an option. The ots ruling impacts two loan products metabank loans refund anticipation loans and. Many people with bad credit assume they can never buy a home. REALTOR -- A Registered collective membership mark that identifies a real estate professional who is a member of the National Association of REALTORS and subscribes to its strict Code of Ethics. Doing your own background check by collecting your financial information will also help you analyze whether you have the capacity to afford a new mortgage. All material on this website, including the logos, and all text, layout, graphics, icons and artwork is Copyright MyFHA.net, Inc., unless otherwise stated. An FHA mortgage can get you into that new home — even if you have bad credit — because the loans are insured by the federal government. Go to the Annual Credit Report website, or print out a form through the Federal Trade Commission’s website to obtain your free copies electronically. A co-signer's signature demonstrates that he is willing to take on the responsibility for repaying your mortgage if you default. Damaged credit is a red flag to lenders because it indicates poor debt management skills. Once proved, the mistake must be repaired within 30 days. Avoid bankruptcy, unless there are no other remedies for your debt situation. Because the underwriting standards for an FHA loan do not follow the stricter guidelines of Fannie Mae and Freddie Mac, used by conventional mortgage lenders, borrowers with a bankruptcy or foreclosure record are eligible to apply. Basically, when you apply for the loan the website makes it look like you are locking in at the rate that you select from a listing of various rates with different closing fees listed. They don’t need to, as they have plenty of business from referrals of people on the inside, the loan officers who work for picky lenders who can’t approve good folks with credit challenges.

Real Estate is a sound investment for now and for the future. These are specialty lenders that do not advertise on the Internet. Use of this web site constitutes acceptance of the eHow Terms of Use and Privacy Policy. Bad credit does not automatically preclude you from obtaining a home loan. The FHA helps people qualify for loans by assuming the risk if the borrower -- that's you -- defaults. Let's work together to buy or sell your next home. VA LoansAlmost any way you slice it, getting your own little piece of the American dream without good credit will cost you more money than if you were a better credit risk. You have to show some current financial responsibility, but you aren't automatically discounted because of a bankruptcy or past foreclosure [source. We offer loans with a dependable guarantee to all of our clients. If your spouse or partner has good credit and will be living in the home with buy a house with bad credit you, consider letting your loved one apply for the loan in her name only. A free mortgage calculator to help you interest only calculator work out the different repayments for. We can also assist in finding a Palm Bay real estate agent, researching Palm Bay Florida home values, or with finding Palm Bay, FL mortgage rates. Since a bankruptcy filing is a significant black mark that stays on a credit report for 10 years, buy a house with bad credit bankruptcy definitely has a negative impact on your chances of getting a home mortgage. Prepare your most recent tax returns, pay stubs, bank statements and W-2s. Simply open it with one click and save it to your computer to read and keep. Ask your friends, family, real estate professionals for a recommendation of an experienced Mortgage Loan Officer - one who specializes in working with those who have credit issues. Getting a cosigner will help improve your chances of approval for a home loan. What this means to you is that I know all aspects of the mortgage business, and I know how the most unlikely candidates get approved for home loans. Current home mortgage rates, loan rates new jersey home loans and other bank interest rates in new. Therefore, they don’t advertise on radio, TV, or Internet. Help for people with a poor credit rating. Line breaks and paragraphs are automatically converted - no need to use <p> or <br> tags. But don't fret; a home inspection can help quell some of those fears. The application takes only 1-minute and is safe and secure. That is why I created an instant download e-book with all the information you need called, How to Buy a House When You Have Bad Credit. If there are any erroneous details that are making your financial situation look worse than it is, you can straighten them out sooner rather than later. Lisa Rudden, Gary Rudden, Rick Reed, and Nick Bobruska have created a business model that benefits the consumer. You may also be able to locate a lending institution that will give you a chance, but at a steep price that usually translates to a high interest rate. Department of Housing and Urban Development (HUD) maintains a referral number where you can get additional information about FHA insurance and discuss your circumstances with a counselor. Don t worry if your credit rating is low our payday loans for bad credit is. Instead, you must go to one of the small to mid-size lenders buy a house with bad credit that specialize in loans for people with credit challenges. Taking that same money and using it to pay a monthly mortgage on your own home is a much better use of your funds. Additionally, there are two lenders for rental/investment properties; and there are two lenders for special niche loans. Ask for help from trained debt professionals. Nowadays it is possible to get a home loan with bad credit scores. Home ownership is the biggest monetary investment many people make in their lifetime.

Subprime loans, or loans for people with less than stellar credit, aren't popular in this economic climate. One way around this hurdle to have another individual with good credit co-sign with you. An FHA loan is a mortgage insured by the federal government and administered by participating lenders. Monies used for the FHA loan down payment may be borrowed or gifted funds from relatives, charities or non-profit organizations. If your poor credit rating stands between you and a conventional mortgage loan, alternative mortgage programs may be the answer. The Fair and Accurate Credit Transactions Act states that if proved wrong, the credit bureau and creditor must make necessary corrections for free. Countrywide/Full Spectrum Lending, First Franklin Wholesale Lending, Guaranty Bank, and others. We decide quickly if we like your proposal, and then we go to work funding your deal. MyFHA makes it easy for you to get a home loan, even with bad credit. It has been updated for 2012-2013, so you receive current mortgage information. There are many home loan companies where a consumer who is already having bad credit profile can get a home loan very easily. You can have your name added to the mortgage title and thus share ownership of the property, regardless of whose name is on the loan paperwork. Do you have an auto loan with lower your car payment another financial institution. |

Seminar Series

Credit and Finance In the NewsPrestige print provide graphic design for mortgage flyer examples mortgage marketing including designs.

Copyright © 1999-2012 Demand Media, Inc. Without a good credit history and score, lenders can also deny a loan outright, make the loan more expensive or heavily reduce your borrowing amount. If you have the necessary resources to pay cash for your home, you wont need a home loan and you can avoid a credit check. Additionally, FHA loans require a smaller down payment compared with a conventional home loan--3.5 percent versus 20 percent. Having said that, we’re pleasantly surprised that Mach by HLB have not gone down the “Step-Up” route where they only give you the advertised rate on the final month (and poor rates in the months before that one), or the “CASA Bundle” route, where you have to put a minimum amount in a low-interest paying account. They wanted to know how to buy a house, even though they had some bad credit.

We are an equity based lender and approve applications based on equity and ability to repay the loan, instead of pat credit and payment history.

We provide FULL SERVICE Buyer and Seller representation using the latest technolgy to save you time and money. If youre having a hard time managing debts, you can always ask for advice from a credit counselor. There are few things more important for home buyers than having good credit. You need never worry about future financial struggles resulting in foreclosure and, according to Realtor.com, sellers will often agree to a lower sales price if the buyer pays with cash rather than financing the purchase.

If youre determined to live the dream now and buy a house no matter what, then there are steps to take on your path to the ultimate debt.

If you can afford to do so, paying cash for your home carries other advantages as well. HUD also recommends contacting your local government and asking about alternative mortgage programs in your area. The material on this site should not be used, copied, stored or transmitted outside of normal use without prior written consent of MyFHA.net, Inc. A co-signer with good credit doesnt erase your poor credit. There are so many options available nowadays, especially because of the rise of Internet banking.

Smart Money Week

If you discover a mistake on your report, get in touch with the consumer bureau and creditor immediately.

The University ForumOur Team was founded in November 2004 by four Real Estate Professionals with extensive ties to the local community and over 50 years of combined experience. My name is Carolyn Warren, and I spent over a dozen years working for some of the largest national lenders. If you have the determination and are willing to take your chances, read on. We aim to help such people who find difficulty in getting financial help. Whereas a few years ago you could get a subprime loan without much trouble, the mortgage mess has led to a lot more caution in the way home loans are approved these days. If you have questions about government programs that could help you qualify, contact a HUD housing counseling agency for more information. We make sure that your property is featured on the world wide web, a customized virtual tour of your home will be professionally created and posted on all the top Real Estate sites. Even if you’ve had accounts forwarded to collections, have filed bankruptcy in the past, or have high debt, you still may qualify. Fannie Mae Dips Further Into Foreclosure Pool.

|

|

|